Will AI Replace Insurance Agents? How Automation Is Reshaping Insurance

If you’ve spent any time in an insurance office lately, you’ve probably overheard someone whispering this like it’s the industry’s version of a jump-scare. And honestly, who can blame them? Between policyholders expecting replies yesterday and the never-ending queue of calls, the idea of a tireless AI assistant sounds both exciting and mildly threatening.

But here’s the plot twist: the real future of insurance isn’t humans versus AI. It’s humans who finally get to breathe because AI handles the repetitive stuff. Imagine delegating all those “Can you resend my policy docs?” calls while you focus on real conversations, actual advising, and clients who need more than a scripted answer.

So, will AI replace insurance agents? Let’s talk about what’s really changing and what’s definitely not going anywhere.

Why the Question Exists: AI’s Growing Role in Insurance

Lately, the question “Will AI replace insurance agents?” seems to pop up in every coffee break conversation or Slack thread at agencies. And it’s not just paranoia.

The reality is, AI is creeping into every corner of insurance, handling tasks that used to make agents groan, roll their eyes, or develop a mild caffeine dependency.

- Speedy responses are the new standard: Customers expect answers in seconds. Whether it’s a quote request or a coverage question, AI can churn out instant replies. Agents used to be the go-to for this, but now bots can do it while you’re still trying to find your pen.

- Repetitive tasks are vanishing from human desks: Data entry, policy renewals, and appointment scheduling used to feel like living in Groundhog Day. AI can automate these, which makes people wonder: if the computer does all this, what’s left for the agent?

- Leads and inquiries need sorting yesterday: Not every lead is ready to buy. AI can filter hot prospects from the tire-kickers before the agent even lifts a finger. It’s like having a coworker who never sleeps, except they don’t steal your coffee.

- 24/7 availability is no longer optional: Insureds don’t care if it’s 2 a.m. or a holiday; they want answers. AI-powered chat or call agents can handle these off-hours questions, making agents look like superheroes when they finally show up for actual human interactions.

- Competitive pressure is real: Agencies adopting AI report faster turnaround and higher client satisfaction. Those who don’t? Well… they’re still sending emails into the void and hoping someone replies.

The truth is, AI is a tool creeping into the parts of insurance work that don’t need a human brain to function. And that’s why the question keeps coming up: it looks like AI can do a lot, but there are still corners only humans can reach.

What AI Can Replace: Tasks Agents Don’t Need to Do Manually

Insurance agents didn’t get into the business to spend half their day doing paperwork, answering the same questions for the hundredth time, or digging through spreadsheets like it’s a treasure hunt. That’s where AI steps in. Think of it as the coworker who does the boring stuff without complaining, asking for coffee, or stealing your stapler.

- Administrative chores and data entry: Updating client info, filing claims forms, and entering new policies. AI can handle this faster than any human and without a single typo. Agents get to keep their sanity, and maybe even remember what day it is.

- Initial customer inquiries: “What’s my deductible?” or “Can you send me a copy of my policy?” AI can answer these instantly, saving agents from reading the same FAQs on repeat.

- Lead sorting and qualification: Not every website form submission is a serious prospect. AI can filter and rank leads, so agents spend time only on clients who are ready to talk, rather than chasing tire-kickers.

- Claims intake and status updates: AI can collect all the basic info for a claim and keep clients updated automatically. Agents get to focus on complex cases instead of fielding 50 “Any updates?” calls per day.

- Basic quotes and comparisons: AI can crunch numbers and provide instant policy options. Agents no longer need to manually pull every rate and calculate coverage for straightforward requests.

AI isn’t replacing agents; it’s replacing the repetitive, time-sucking parts of their jobs. That leaves the humans free to do what machines can’t: make judgment calls, handle sensitive situations, and build real relationships with clients.

How AI Improves Insurance Operations Today

AI in insurance isn’t about replacing humans. It’s about making operations smoother, faster, and far less headache-inducing. Think of it like having a tireless assistant who never complains, never takes a coffee break, and never misplaces a file.

- 24/7 availability: Clients don’t work 9-to-5, so why should your support? AI-powered chatbots and call agents can answer questions in the middle of the night, ensuring policyholders aren’t left screaming into voicemail.

- Faster response times: No more agents juggling 20 emails and 10 phone calls at once. AI can instantly provide quotes, answer policy questions, and schedule follow-ups, so clients get what they need without tapping their fingers on the desk.

- Reduced operational costs: Fewer repetitive tasks for humans means fewer errors, less overtime, and no need to hire extra staff just to manage admin work. That’s money saved for more strategic priorities.

- Consistent, accurate information: AI doesn’t forget details or mix up policy numbers. Every client gets precise information every time, no accidental “Oops, wrong coverage” moments.

- Better lead nurturing and follow-up: AI can automatically send reminders, follow-up emails, and even make outbound calls, keeping prospects engaged without agents having to micromanage every interaction.

- Scalability without stress: Whether it’s a sudden spike in claims after a storm or a flood of quote requests, AI can handle the volume without breaking a sweat, something humans would need a dozen energy drinks for.

In short, AI frees agents to focus on what really matters: building relationships, giving tailored advice, and handling complex situations that require human judgment. It’s not a threat; it’s the secret weapon that makes insurance teams work smarter, not harder.

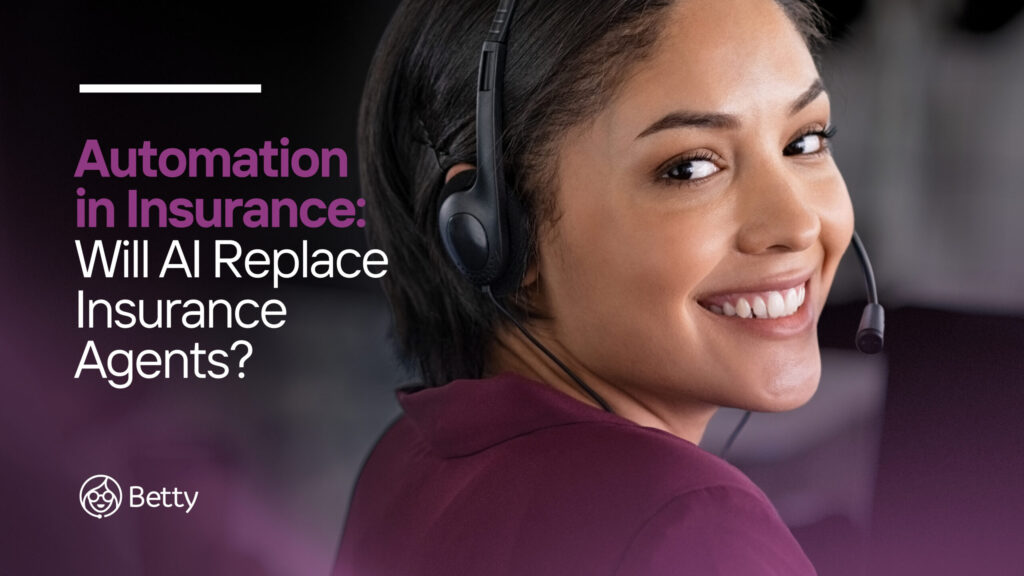

Introducing the Right AI for Insurance Teams: Betty AI

If AI is the future of insurance operations, the real question becomes: which AI actually helps agents instead of replacing them? Enter Betty AI, your no-nonsense, no-code call agent that handles the repetitive stuff so your human agents can focus on the clients who need real advice.

Create Your Voice Profile

- Choose a tone that fits your brand: friendly, professional, or somewhere in between.

- Betty adapts to how you want your clients to feel, whether that’s reassured, informed, or just mildly entertained during a long claims call.

Set Up Your Agent Profile

- Define Betty’s role: sales, support, claims intake, or lead screening.

- Customize scripts and conversation flows so she knows exactly what to do—without asking for a coffee break or complaining about Mondays.

Integrate With Your Tech Stack

- Seamlessly sync Betty with CRMs, help desks, and policy management tools.

- No coding required. Plug, play, and watch her take over the tedious tasks without a single “oops.”

Launch & Monitor

- Go live quickly and keep tabs on performance from one dashboard.

- Adjust settings, tweak scripts, and optimize conversations in real time.

- It’s like having a tireless agent who actually enjoys handling the boring stuff.

With Betty AI, insurance teams can finally stop treating repetitive calls and administrative tasks as a full-time job. Agents get to focus on real conversations, complex cases, and relationship-building—all while clients get faster, more consistent service.

Closing Thoughts

The truth? AI isn’t here to replace agents; it’s here to make their lives easier. By taking over repetitive tasks, handling routine questions, and keeping clients updated around the clock, AI gives agents the freedom to focus on what really matters: complex cases, strategic advice, and building trust.

If you’re ready to see how AI can support your insurance team without replacing the humans who make it personal, try Betty today for free.

FAQs

Will AI completely replace insurance agents?

No. AI handles repetitive tasks and routine inquiries, but human agents are essential for complex advice, empathy, and relationship-building.

What tasks can AI do in insurance?

AI can manage claims intake, lead qualification, policy updates, FAQs, and basic quotes. Freeing agents to focus on higher-value work.

How does AI improve customer service in insurance?

It provides 24/7 support, faster response times, and consistent information. Reducing wait times and errors for clients.

Can AI work alongside existing insurance systems?

Yes. Tools like Betty AI integrate with CRMs, help desks, and policy management systems using no-code APIs, making implementation simple.